Penilaian Kinerja Keuangan Perguruan Tinggi Menggunakan Analisis Rasio Keuangan dan Konsep EVA (Economic Value Added) (Studi pada Universitas Nusa Lontar Rote Periode 2019-2021)

DOI:

https://doi.org/10.31933/jimt.v4i6.1629Keywords:

Activity, EVA, Financial Performance, Liquidity, Leverage, ProfitabilityAbstract

The purpose of this study is to determine the assessment of the company's financial performance using financial ratio analysis and the concept of Economic Value Added (EVA). The research method used is descriptive with a quantitative approach. The object of this research is the University of Nusa Lontar Rote. From all the financial ratio analysis used, it can be concluded that the financial ratios of the University of Nusa Lontar Rote are able to manage assets and capital to increase sales and profits by better financing debt obligations. The financial performance of the University of Nusa Lontar Rote, for the 2019-2021 period, measured from this EVA calculation, has increased every year in the three years of the study period. A high EVA value will attract investors, because the greater the EVA value, the higher the value of the institution, which means the greater the benefits enjoyed. This indicates that the University of Nusa Lontar Rote is able to create added economic value for the institution and is able to meet the expectations of shareholders and investors.

References

Hanafi, MM dan Halim Abdul. (2016). Analisis Laporan Keuangan.Yogyakarta: UPP STIM YKPN.

Hery. (2018). Analisis Laporan Keuangan. Jakarta: PT Grasindo.

Jumingan. (2011). Analisis Laporan Keuangan. Jakarta: Bumi Aksara.

Margaretha, Farah. (2011). Manajemen Keuangan untuk Manajer Non Keuangan. Jakarta:Erlangga.

Riyanto, Bambang. (2010). Dasar-Dasar Pembelanjaan Perusahaan. Edisi Keempat.Yogyakarta: BPFE.

Rudianto. (2013). Akuntansi Manajemen. Jakarta: Erlangga.

Subramanyam dan Wild, John. (2013). Analisis Laporan Keuangan Buku 1. Jakarta: Salemba Empat

Sudana, I Made. (2009). Manajemen Keuangan Teori dan Praktik. Surabaya: Airlangga University Press.

Syamsuddin, Lukman. (2016). Manajemen Keuangan Perusahaan Konsep Aplikasi Dalam: Perencanaan, Pengawasan dan Pengambilan Keputusan. Jakarta: PT Rajagrafindo Persada.

Witjaksana, B. (2019). Model Activity Based Management Change Order Berbasis Economic Value Added Melalui Efektifitas Dan Efisiensi Untuk Meningkatkan Kinerja Keuangan Proyek Konstruksi Gedung Di Kota Surabaya. Surabaya: CV. Qara media.

Downloads

Published

How to Cite

Issue

Section

License

Penulis yang mempublikasikan manuskripnya di jurnal ini menyetujui ketentuan berikut:

- Hak cipta pada setiap artikel adalah milik penulis.

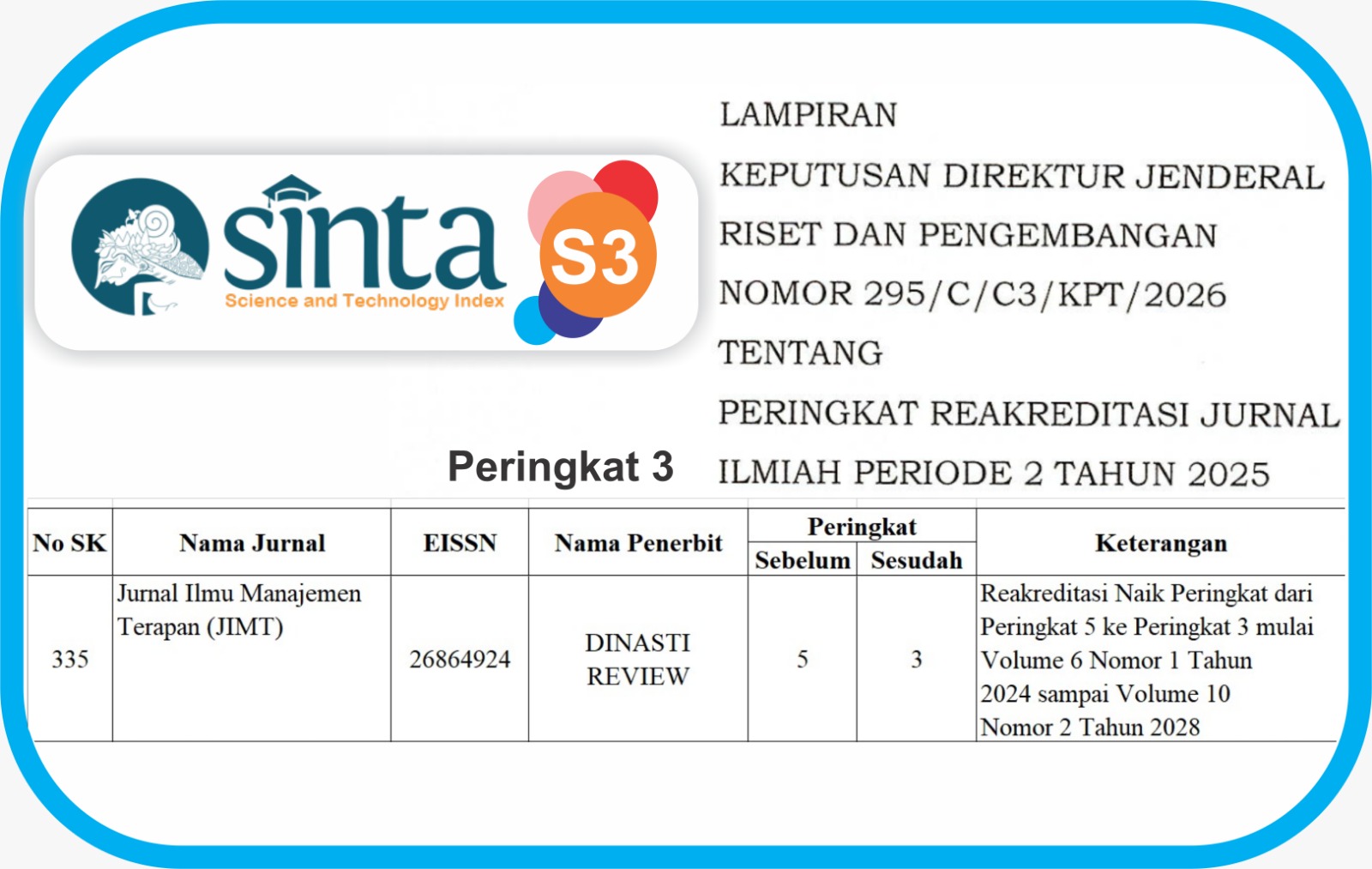

- Penulis mengakui bahwaJurnal Ilmu Manajemen Terapan (JIMT) berhak menjadi yang pertama menerbitkan dengan lisensi Creative Commons Attribution 4.0 International (Attribution 4.0 International CC BY 4.0) .

- Penulis dapat mengirimkan artikel secara terpisah, mengatur distribusi non-eksklusif manuskrip yang telah diterbitkan dalam jurnal ini ke versi lain (misalnya, dikirim ke repositori institusi penulis, publikasi ke dalam buku, dll.), dengan mengakui bahwa manuskrip telah diterbitkan pertama kali di Jurnal Ilmu Manajemen Terapan (JIMT).