Aspek Pelindungan Hukum Atas Data Pribadi Nasabah pada Penyelenggaraan Layanan Mobile Banking pada PT. Bank Rakyat Indonesia Cabang Stabat

DOI:

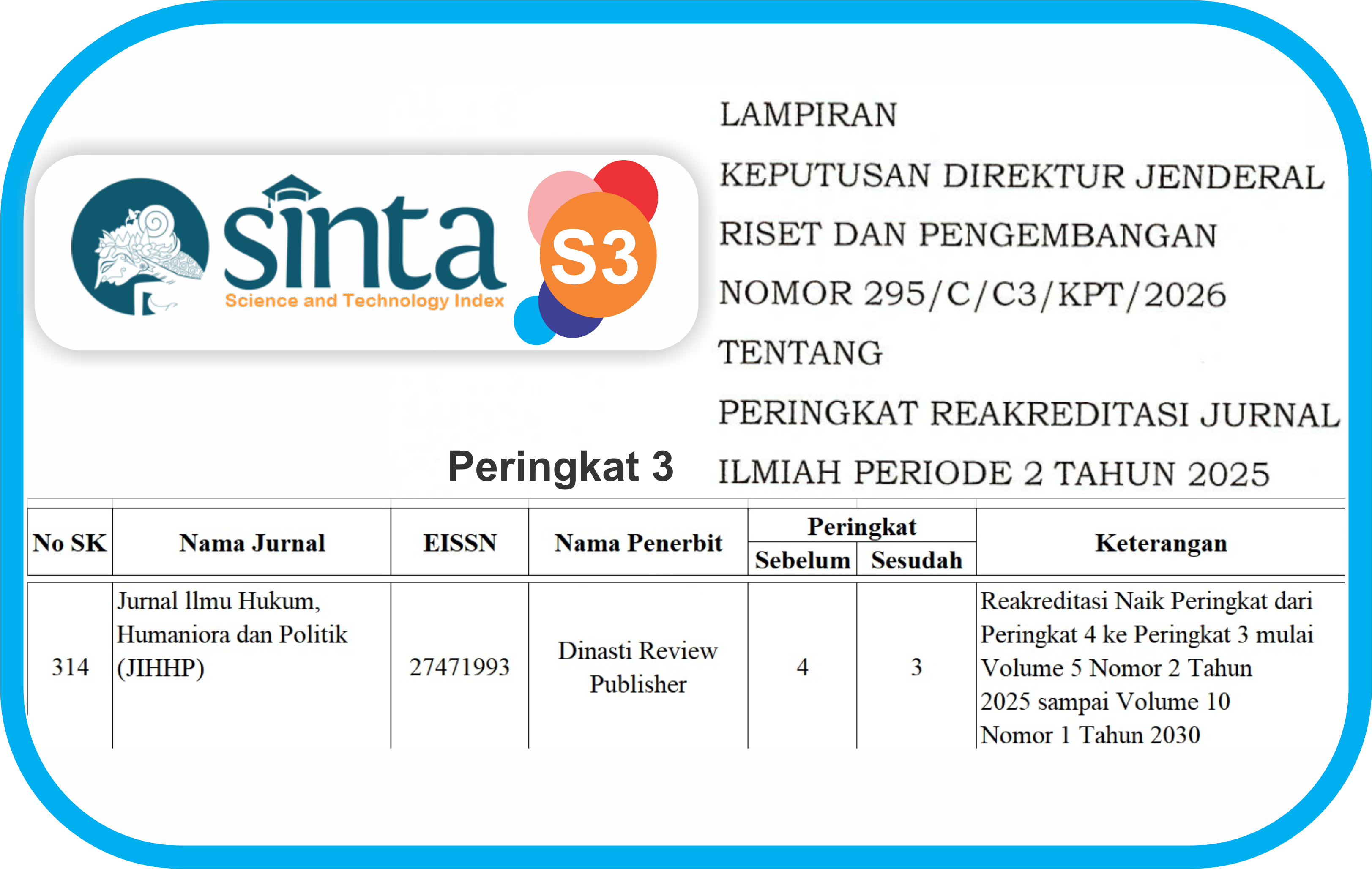

https://doi.org/10.38035/jihhp.v4i5.2211Keywords:

Legal Protection, Bank, CustomerAbstract

The development of information technology, especially in the banking sector, customers can now easily access their financial services through mobile banking platforms. However, amidst such convenience, there are concerns about the security of customer data. The focus of this research is on written law or law on the books and customs, as the protection of personal data is crucial as the data stored in the banking system includes financial details, personal identity, and other sensitive data. This research uses normative legal research methods, which are also known by other terms such as positive legal research methods, doctrinal legal research methods, and pure legal research methods. The main regulations in Indonesia in this case are Law Number 19 of 2016 concerning Electronic Information and Transactions (UU ITE), as well as Bank Indonesia Regulations (PBI) regarding Information Security and Banking Transactions (PBI 18/40/PBI/2016). Protecting the personal data of BRI mobile banking customers requires a deep understanding of the various types of digital crime, including social engineering practices. With appropriate protection measures and high awareness from all relevant parties, it is expected to effectively reduce the risk of data leakage and maintain the security of clients' personal data.

References

Afifah, N. (2021). Pengaruh Kualitas Layanan Terhadap Komitmen Afektif, Komitmen Normatif, Komitmen Kontinuan Serta Loyalitas Nasabah Debitur Pada Pt. Bank Kalbar Di Kalimantan Barat. Jurnal Manajemen Teori Dan Terapan| Journal of Theory and Applied Management, 5(2). https://doi.org/10.20473/jmtt.v5i2.2558

Arsha Putra, I. P. R., & Yustiawan, D. G. P. (2022). Aspek Pelindungan Hukum Terhadap Nasanah Atas Penyelenggaraan E-Payment Berbasis QR-Code. Kertha Wicaksana, 16(2), 99–107. https://doi.org/10.22225/kw.16.2.2022.99-107

Don Rade, S., Tadeus, D. W., & Gana, G. (2021). Kerahasiaan Bank Sebagai Bentuk Pelindungan Data Nasabah (Kasus pada PT. Bank Cimb Niaga Tbk). Jurnal Sosial Sains, 1(8), 892–909. https://doi.org/10.36418/sosains.v1i8.183

Firmanda, A. F., & Lukiastuti, F. (2022). Analisisi Peran Mediasi Kepuasan Nasabah Pada Hubungan Digital Marketing Dan Brand Loyalty Pada Bank Jateng Cabang Wonosobo. Among Makarti, 14(2), 29–49. https://doi.org/10.52353/ama.v14i2.212

Mahmud, A., & Nurmiati. (2022). Marketing Mix?: Keputusan Nasabah Memilih Tabungan Simpeda Pada Bank Sulselbar. Laa Maisyir Jurnal Ekonomi Islam, 9(2), 1–18.

Mundir, A., Nizar, M., & Athiroh, D. R. (2022). Pengaruh Kualitas Layanan, Kepuasan, Dan Kepercayaan Pada Penggunaan Aplikasi Mobile banking Terhadap Mahasiswa Sebagai Nasabah Bank Syariah Di Universitas Yudharta Pasuruan. JPSDa: Jurnal Perbankan Syariah Darussalam, 2(1), 1–17. https://doi.org/10.30739/jpsda.v2i1.1273

Nurhilmiyah. (2015). Tahapan Dalam Pelaksanaan Perjanjian Pembiayaan. Jurnal Fakultas Hukum Universitas Muhammadiyah Sumatera Utara, (2015) 1(January) 21-30, 1999(December), 1–6.

Sudirman, I. M. S. A. S., & Suasana, I. G. A. K. G. (2018). Pengaruh Kualitas Layanan Online Terhadap Kepuasan, Komitmen, Dan Loyalitas Nasabah Internet Banking Di Kota Denpasar. INOBIS: Jurnal Inovasi Bisnis Dan Manajemen Indonesia, 1(4), 473–488. https://doi.org/10.31842/jurnal-inobis.v1i4.52

Supra, E., & Hendarsyah, D. (2022). Determinan Kepuasan Nasabah Pada Bank Syariah Indonesia. El-Jizya?: Jurnal Ekonomi Islam, 10(1), 33–50. https://doi.org/10.24090/ej.v10i1.6235

Sutomo, D. A., & Rofiuddin, M. (2022). Loyalitas nasabah pada Bank Syariah Indonesia: Dampak relationship marketing dan mobile banking dengan switching barrier sebagai variabel moderating. Journal of Management and Digital Business, 2(1), 39–47. https://doi.org/10.53088/jmdb.v2i1.153

Sutra Disemadi, H. (2021). Pelindungan Nasabah Dalam Penerapan Electronic Banking Sebagai Bagian Aktifitas Bisnis Perbankan Di Indonesia. Jurnal Perspektif Administrasi Dan Bisnis, 2(1), 27–40. https://doi.org/10.38062/jpab.v2i1.16

Walean, R. H., & Talumantak, J. P. P. (2021). Pemodelan Persamaan Struktural Pada Adopsi Mobile banking Studi Kasus: Bsgtouch Bank Sulutgo Structural Equation Modeling On Mobile banking Adoption Case Study: Bsgtouch Of Bank Sulutgo. Cogito Smart Journal |, 7(2), 2024211–2024435.

Wardani, D. (2021). Faktor-Faktor Pengaruh Penggunaan Mobile banking. Jurnal Sistem Informasi Bisnis (JUNSIBI), 2(1), 15–32. https://doi.org/10.55122/junsibi.v2i1.253

Widyayanti, E. R., & Hamid, M. (2022). Pengaruh Penggunaan Layanan Electronic Banking Terhadap Kepuasan Nasabah Di Daerah Istimewa Yogyakarta. Jurnal Riset Akuntansi Dan Bisnis Indonesia, 2(4), 1136–1157. https://doi.org/10.32477/jrabi.v2i4.615

Zulkifly, Z. A., Brasit, N., Alhaqqi, M. S., & Adelia, S. (2022). Analisis Peningkatan Kualitas Layanan Mobile banking dengan Pendekatan Metode E-Servqual. JBMI (Jurnal Bisnis, Manajemen, Dan Informatika), 19(1), 61–79. https://doi.org/10.26487/jbmi.v19i1.21337

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Riza Diandra Tanjung, Nurhilmiyah Nurhilmiyah

This work is licensed under a Creative Commons Attribution 4.0 International License.

Hak cipta :

Penulis yang mempublikasikan manuskripnya di jurnal ini menyetujui ketentuan berikut:

- Hak cipta pada setiap artikel adalah milik penulis.

- Penulis mengakui bahwa Jurnal Ilmu Hukum, Humaniora dan Politik (JIHHP) berhak menjadi yang pertama menerbitkan dengan lisensi Creative Commons Attribution 4.0 International (Attribution 4.0 International CC BY 4.0) .

- Penulis dapat mengirimkan artikel secara terpisah, mengatur distribusi non-eksklusif manuskrip yang telah diterbitkan dalam jurnal ini ke versi lain (misalnya, dikirim ke repositori institusi penulis, publikasi ke dalam buku, dll.), dengan mengakui bahwa manuskrip telah diterbitkan pertama kali di JIHHP.