Penelitian Empiris Menyelidiki Dampak Dewan Perusahaan Terhadap Keputusan Leverage di Bank-Bank Indonesia

DOI:

https://doi.org/10.38035/jmpis.v5i3.1877Keywords:

Empirical Research, Corporate Board, Leverage Decision.Abstract

Tujuan dari penelitian ini adalah untuk menganalisis pengaruh jenis kelamin dewan direksi, ukuran dewan direksi, rapat dewan direksi, profitabilitas, kepemilikan dewan direksi, ukuran perusahaan, big4, dan pertumbuhan ekonomi terhadap tingkat leverage bank. Metode yang digunakan adalah metode regresi data panel yang terdiri dari common effect (pooled less square), fixed effect dan random effect. Hasil penelitian menunjukkan bahwa Board Female Gender, Board Meeting, Board Ownership, Profitability, Big4, Inflation berpengaruh terhadap Leverage. Board Size, Firm Size, Economic Growth tidak berpengaruh terhadap Leverage.

References

Adabenege, O., Bsc, Y., Mba, M., Fipan, P., Fsim, F., Cna, M., Ibrahim, M., & Yahaya, O. A. (2023). Ownership Structure and Leverage Decisions. Article in Australasian Accounting Business and Finance Journal. https://doi.org/10.14453/aabfj.v17i4.15

Alabdullah, T. T. Y., Al-Fakhri, I., Ries, E., & Abdulkarim, K.-J. (2021). Empirical Study Of The Influence Of Board Of Directors’ Feature On Firm Performance. Russian Journal of Agricultural and Socio-Economic Sciences, 119(11), 137–146. https://doi.org/10.18551/rjoas.2021-11.16

Assfaw, A. M. (2020). The Determinants of Capital structure in Ethiopian Private Commercial Banks: A Panel Data Approach. Journal of Economics, Business, & Accountancy Ventura, 23(1). https://doi.org/10.14414/jebav.v23i1.2223

Ezeani, E., Kwabi, F., Salem, R., Usman, M., Alqatamin, R. M. H., & Kostov, P. (2023). Corporate board and dynamics of capital structure: Evidence from UK, France and Germany. International Journal of Finance and Economics, 28(3), 3281–3298. https://doi.org/10.1002/ijfe.2593

Harasheh, M., & De Vincenzo, F. (2023). Leverage-value nexus in Italian small-medium enterprises: further evidence using dose-response function. EuroMed Journal of Business, 18(2), 165–183. https://doi.org/10.1108/EMJB-11-2021-0166

Hordofa, D. F. (2023). The impact of board gender diversity on capital structure: Evidence from the Ethiopian banking sector. Cogent Business and Management, 10(3). https://doi.org/10.1080/23311975.2023.2253995

Samaila, N., Suleiman, R., & Yahaya, O. A. (2023). Corporate boards and leverage decisions. Accounting Forum, 47(2), 307–326. https://doi.org/10.1080/01559982.2022.215877x

Tahir, H., Rahman, M., Masud, M. A. K., & Rahman, M. M. (2023). Unveiling the Link between Corporate Board Attributes, Board Behavior, and Financial Leverage: Insights from Malaysia. Journal of Risk and Financial Management, 16(4). https://doi.org/10.3390/jrfm16040237

Tawfeeq Yousif Alabdullah, T., & Khaled Mohamed, Z. (2023). Exploring The Impact Ceo Duality, Firm Size, And Board Size On Capital Structure Based On The Knowledge Management During The Covid-19 Pandemic. In Management, Economics and Social Sciences. IJAMESC, PT. ZillZell Media Prima, 2023. IJAMESC (Vol. 1, Issue 4).

Wided, B., & Yosr, H. (2022). The composition of board of directors and performance: Impact of the political experience after the Tunisian revolution. Journal of Accounting and Taxation, 14(1), 37–51. https://doi.org/10.5897/jat2020.0432

Yakubu, I. N., & Oumarou, S. (2023). Boardroom dynamics: The power of board composition and gender diversity in shaping capital structure. Cogent Business and Management, 10(2). https://doi.org/10.1080/23311975.2023.2236836

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Marji Uliansyah, Indra Maulana, Christy Yanwar Yosapat, Henny Setyo Lestari, Farah Margaretha

This work is licensed under a Creative Commons Attribution 4.0 International License.

Hak cipta :

Penulis yang mempublikasikan manuskripnya di jurnal ini menyetujui ketentuan berikut:

- Hak cipta pada setiap artikel adalah milik penulis.

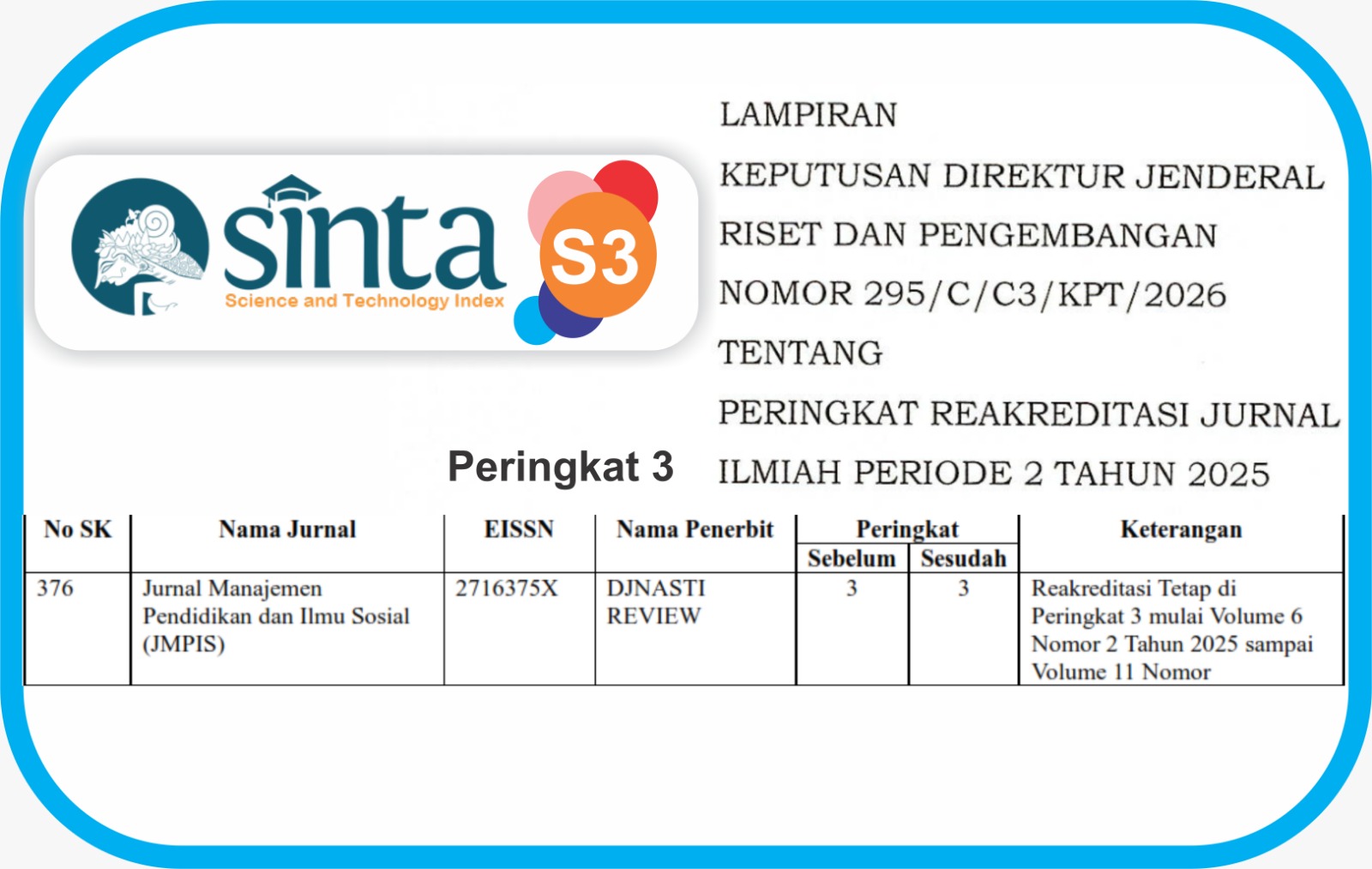

- Penulis mengakui bahwa Jurnal Manajemen Pendidikan dan Ilmu Sosial (JMPIS) berhak menjadi yang pertama menerbitkan dengan lisensi Creative Commons Attribution 4.0 International (Attribution 4.0 International CC BY 4.0) .

- Penulis dapat mengirimkan artikel secara terpisah, mengatur distribusi non-eksklusif manuskrip yang telah diterbitkan dalam jurnal ini ke versi lain (misalnya, dikirim ke repositori institusi penulis, publikasi ke dalam buku, dll.), dengan mengakui bahwa manuskrip telah diterbitkan pertama kali di Jurnal Manajemen Pendidikan dan Ilmu Sosial (JMPIS).