Implementasi Blockchain Pada Bidang Keunagan Digital

DOI:

https://doi.org/10.38035/jimt.v6i5.5314Keywords:

Blockchain, Digital Finance, Defi, Smart ContractAbstract

This research aims to spread the implementation of blockchain technology in the digital financial sector through a literature study approach. The main issue raised is how blockchain is applied in financial services and what challenges and benefits come with it. The method used was a literature review of 18 relevant scientific articles. The analysis results show that blockchain has been implemented in four main categories, namely cryptocurrency, cross-border payments, decentralized finance (DeFi), and smart contracts. This implementation provides significant benefits such as transparency, cost and time efficiencies, and increased security. However, blockchain implementation still faces serious challenges such as regulatory ambiguity, scalability issues, cybersecurity risks, and low adoption by traditional financial institutions. This research suggests the importance of strengthening regulations, technical innovation, and increasing technological literacy to encourage broader and more effective blockchain implementation in digital financial systems.

References

Buterin, V. (2014). A next-generation smart contract and decentralized application platform. white paper, 3(37), 2-1.

Cachin, C. (2016, July). Architecture of the hyperledger blockchain fabric. In Workshop on distributed cryptocurrencies and consensus ledgers (Vol. 310, No. 4, pp. 1-4).

Chen, S., Chen, C. Y. H., Härdle, W. K., Lee, T. M., & Ong, B. (2018). Econometric analysis of a cryptocurrency index for portfolio investment. In Handbook of Blockchain, Digital Finance, and Inclusion, Volume 1 (pp. 175-206). Academic Press.

Christidis, K., & Devetsikiotis, M. (2016). Blockchains and smart contracts for the internet of things. IEEE access, 4, 2292-2303.

Choo, K. K. R. (2015). Cryptocurrency and virtual currency: Corruption and money laundering/terrorism financing risks?. In Handbook of digital currency (pp. 283-307). Academic Press.

Deloitte. (2021). Blockchain: A Game Changer for Financial Institutions. Deloitte Insights, 2021. (European Central Bank, 2019) European Central Bank, "Crypto-Assets: Implications for Financial Stability, Monetary Policy, and Payments and Market Infrastructures," ECB Report, 2019.

Halaburda, H., Haeringer, G., Gans, J., & Gandal, N. (2022). The microeconomics of cryptocurrencies. Journal of Economic Literature, 60(3), 971-1013.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Satoshi Nakamoto.

Narayanan, A., Bonneau, J., Felten, E., Miller, A., & Goldfeder, S. (2016). Bitcoin and cryptocurrency technologies: a comprehensive introduction. Princeton University Press.

Parizi, R. M., Amritraj, & Dehghantanha, A. (2018). Smart contract programming languages on blockchains: An empirical evaluation of usability and security. In Blockchain–ICBC 2018: First International Conference, Held as Part of the Services Conference Federation, SCF 2018, Seattle, WA, USA, June 25-30, 2018, Proceedings 1 (pp. 75-91). Springer International Publishing.

Sbarcea, I. R. (2019). Banks digitalization-a challenge for the Romanian banking sector. Studies in Business and Economics, 14(1), 221-230.

Schär, F. (2021). Decentralized finance: on blockchain and smart contract-based financial markets. Review of the Federal Reserve Bank of St Louis, 103(2), 153-174.

Szabo, N. (1997). Formalizing and securing relationships on public networks. First monday.

Taylor, P. J., Dargahi, T., Dehghantanha, A., Parizi, R. M., & Choo, K. K. R. (2020). A systematic literature review of blockchain cyber security. Digital Communications and Networks, 6(2), 147-156.

Tredinnick, L. (2019). Cryptocurrencies and the blockchain. Business Information Review, 36(1), 39-44.

Tschorsch, F., & Scheuermann, B. (2016). Bitcoin and beyond: A technical survey on decentralized digital currencies. IEEE Communications Surveys & Tutorials, 18(3), 2084-2123.

World Economic Forum. (2016). The Future of Financial Infrastructure: An Ambitious Look at How Blockchain Can Reshape Financial Services. WEF Report.

Yli-Huumo, J., Ko, D., Choi, S., Park, S., & Smolander, K. (2016). Where is current research on blockchain technology?—a systematic review. PloS one, 11(10), e0163477.

Zheng, Z., Xie, S., Dai, H., Chen, X., & Wang, H. (2017, June). An overview of blockchain technology: Architecture, consensus, and future trends. In 2017 IEEE international congress on big data (BigData congress) (pp. 557-564). Ieee.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Zeinan Ramadan, Fidi Supriadi, Dani Indra Junaedi

This work is licensed under a Creative Commons Attribution 4.0 International License.

Penulis yang mempublikasikan manuskripnya di jurnal ini menyetujui ketentuan berikut:

- Hak cipta pada setiap artikel adalah milik penulis.

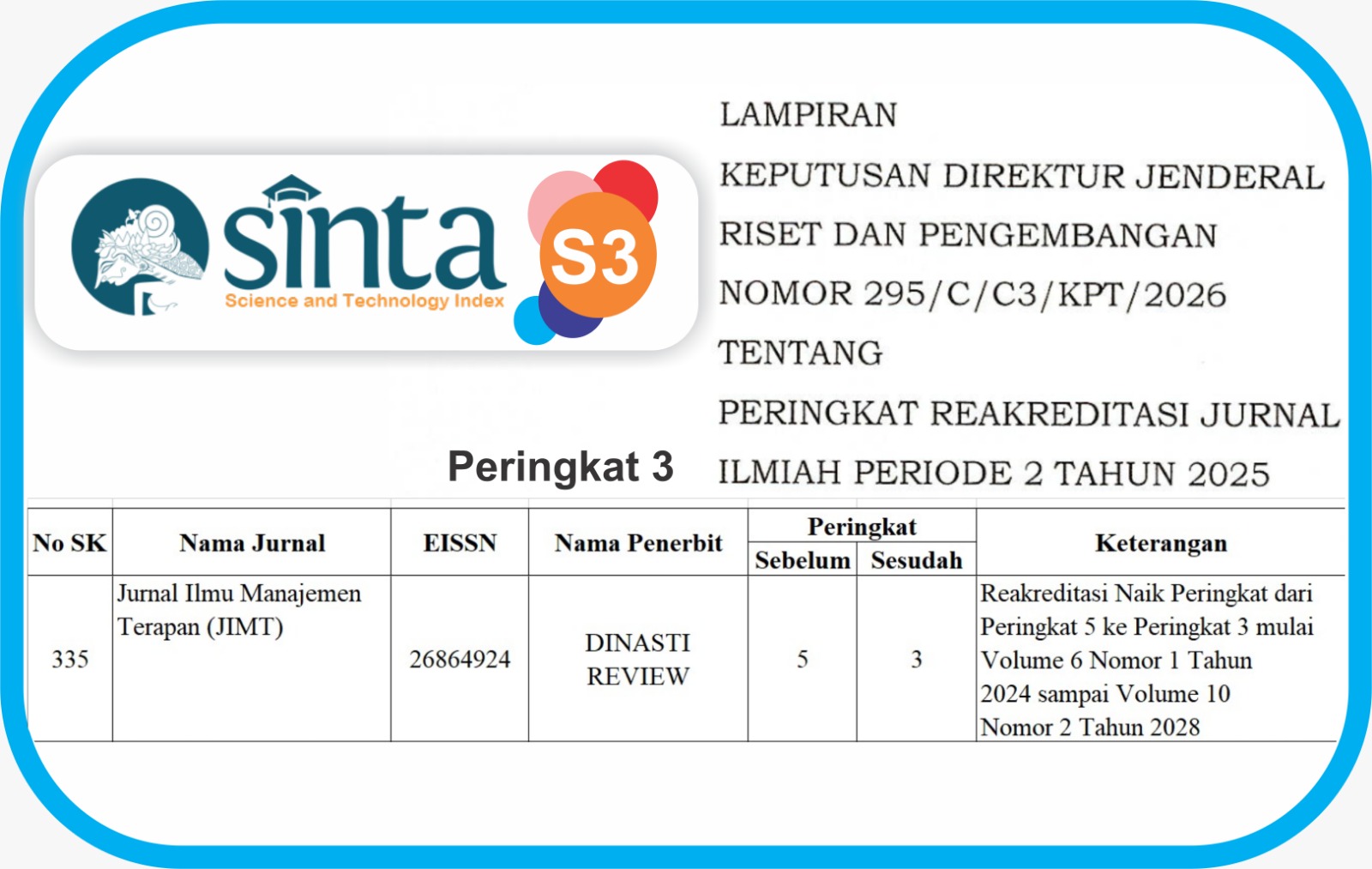

- Penulis mengakui bahwaJurnal Ilmu Manajemen Terapan (JIMT) berhak menjadi yang pertama menerbitkan dengan lisensi Creative Commons Attribution 4.0 International (Attribution 4.0 International CC BY 4.0) .

- Penulis dapat mengirimkan artikel secara terpisah, mengatur distribusi non-eksklusif manuskrip yang telah diterbitkan dalam jurnal ini ke versi lain (misalnya, dikirim ke repositori institusi penulis, publikasi ke dalam buku, dll.), dengan mengakui bahwa manuskrip telah diterbitkan pertama kali di Jurnal Ilmu Manajemen Terapan (JIMT).