Pengaruh Financial Technology Terhadap Financial Satisfaction Pada UMKM Di Kota Jambi Dengan Disruptive Technology Sebagai Variabel Mediasi

DOI:

https://doi.org/10.38035/jimt.v5i5.2261Keywords:

UMKM, Fintech, Financial Satisfaction, Disruptive TechnologyAbstract

Financial Technology (FinTech) and Micro, Small, and Medium Enterprises (MSMEs) exhibit several important dynamics within the financial ecosystem and business development. FinTech has had a significant impact on MSMEs, especially in terms of access to financial services that were previously difficult for this sector to reach, including enhancing financial satisfaction. This study aims to analyze the influence of Financial Technology on Financial Satisfaction in MSMEs in Jambi City, with Disruptive Technology as a mediating variable. This research is quantitative and analyzed using SEM PLS. The study population consists of MSME owners in Jambi City. The study concludes as follows: Financial Technology has a direct impact on Financial Satisfaction. Good Financial Technology will improve Financial Satisfaction. Similarly, Disruptive Technology can enhance Financial Satisfaction. Disruptive Technology as a mediating factor can enhance the influence of Financial Technology on Financial Satisfaction in MSMEs in Jambi City.

References

Chen, J., Zhu, Z., & Zhang, Y. (2017). A study of factors influencing disruptive innovation in Chinese SMEs. Asian Journal of Technology Innovation, 25(1), 140–157. https://doi.org/10.1080/19761597.2017.1302552

Coffie, C. P. K., Hongjiang, Z., Mensah, I. A., Kiconco, R., & Simon, A. E. O. (2021). Determinants of FinTech payment services diffusion by SMEs in Sub-Saharan Africa: evidence from Ghana. Information Technology for Development, 27(3), 539–560. https://doi.org/10.1080/02681102.2020.1840324

Dare, S. E., van Dijk, W. W., van Dijk, E., van Dillen, L. F., Gallucci, M., & Simonse, O. (2020). The Road to Financial Satisfaction: Testing the Paths of Knowledge, Attitudes, Sense of Control, and Positive Financial Behaviors. Journal of Financial Therapy, 11(2), 1–30. https://doi.org/10.4148/1944-9771.1240

Dipleep. Kumar M, Fenn, C. J., & S.G, N. (2019). Technology disruption and business performance in SMEs. Religación. Revista de Ciencias Sociales y Humanidades, 4(17), 3–5. https://www.researchgate.net/publication/330823431

Farida, M. N., Soesatyo, Y., & Aji, T. S. (2021). Influence of Financial Literacy and Use of Financial Technology on Financial Satisfaction through Financial Behavior. International Journal of Education and Literacy Studies, 9(1), 86. https://doi.org/10.7575/aiac.ijels.v.9n.1p.86

Ferdinand, agusty. (2012). Metode Penelitian Manajemen. Universitas diponegoro semarang.

Ghani, E. K., & Khalil, N. A. (2021). Adoption intention of e-wallet services among small medium enterprises in retail industry: An application of the diffusion of innovation theory factors influencing. Universidad y Sociedad, 13(5), 53–64.

Ghozali, I. (2015). Konsep, Teknik, Aplikasi Menggunakan Smart PLS 3.0 Untuk Penelitian Empiris. Universitas diponegoro semarang.

Hakimah, Y., Pratama, I., Fitri, H., Ganatri, M., & Sulbahri, R. A. (2019). Impact of intrinsic corporate governance on financial performance of indonesian SMEs. International Journal of Innovation, Creativity and Change, 7(1), 32–51.

Hasibuan, B. K., Lubis, Y. M., & HR, W. A. (2018). Financial Literacy and Financial Behavior as a Measure of Financial Satisfaction. 46(Ebic 2017), 503–507. https://doi.org/10.2991/ebic-17.2018.79

Humaira, L. L., Syamsudin, & Isa, M. (2020). M-Wallet Adoption and SMEs Performance: The Mediating Role of Internal Process Collaboration. Proceedings of the International Conference on Business and Management Research (ICBMR 2020) M-Wallet, 160(Icbmr), 29–35.

Hutapea, R. S. (2020). The Effect of Financial Technology (Fin-Tech) on Customer Satisfaction Level (A Case Study on SMEs). 198(Issat), 668–674. https://doi.org/10.2991/aer.k.201221.107

Kemenkop. (2018). Kementerian Koperasi dan UMKM.

Lew, S., Tan, G. W. H., Loh, X. M., Hew, J. J., & Ooi, K. B. (2020). The disruptive mobile wallet in the hospitality industry: An extended mobile technology acceptance model. Technology in Society, 63(July), 101430. https://doi.org/10.1016/j.techsoc.2020.101430

M, D. K., Fenn, C. J., & S.G, N. (2019). Technology: Disruption and Convergence. Nóesis. Revista de Ciencias Sociales y Humanidades ·, February. http://www.london.gov.uk/london-house/technology-disruption-and-convergence

Majid, N., Ika, N., Wardhani, K., & Fitriyah, Z. (2023). Empowering SMES Performance through Digital Economy using Social Media and E-Wallet. 7st International Seminar of Research Month 2022, 2023, 451–453.

Margaretha, F., & Supartika, N. (2016). Factors Affecting Profitability of Small Medium Enterprises ( SMEs ) Firm Listed in Indonesia Stock Exchange. Journal of Economics, Business and Management, 4(2), 132–137. https://doi.org/10.7763/JOEBM.2016.V4.379

Ngamaba, K. H., Armitage, C., Panagioti, M., & Hodkinson, A. (2020). How closely related are financial satisfaction and subjective well-being? Systematic review and meta-analysis. Journal of Behavioral and Experimental Economics , 85(January), 101522. https://doi.org/10.1016/j.socec.2020.101522

Purwati, A. A., Budiyanto, Suhermin, & Hamzah, M. L. (2020). The effect of innovation capability on business performance: the role of social capital and entrepreneurial leadership on smes in indonesia. Accounting, 7(2), 323–330. https://doi.org/10.5267/j.ac.2020.11.021

Rahadjeng, E. R., & Fiandari, Y. R. (2022). The Effect of Financial Technology on the Financial Satisfaction of MSMEs in Malang. Manajemen Bisnis, 12(01), 01–07. https://doi.org/10.22219/mb.v12i01.19218

Sawitri, N. N. (2018). Behavior in managing revenue to achieve financial satisfaction. Opcion, 34(86), 1274–1291.

Siew Bee, T., & Yan Ying, K. (2021). An examination of determinants for e-wallet adoption in Malaysia: a combined approach. F1000Research, 10(May), 1155. https://doi.org/10.12688/f1000research.73402.1

Singh, D. S. M., & Hanafi, N. B. (2019). INNOVATION CAPABILITY, AND SME’S PERFORMANCE IN MALAYSIA, MEDIATE BY DISRUPTIVE TECHNOLOGY. Qualitative and Quantitative Research Review, 4(3), 122–130.

Singh, D., Singh, M., & Hanafi, N. B. (2019). Disruptive Technology and SMEs Performance in Malaysia. International Journal of Academic Research in Business and Social Sciences, 9(12), 136–148. https://doi.org/10.6007/IJARBSS/v9-i12/6681

Sugiyono. (2015). Metode Penelitian Pendekatan Kuantitatif, dan kualitatif. Alfabeta.

Sugiyono. (2020). Metode Penelitian Pendekatan Kuantitatif,Kualitatif dan R & D. Alfa Beta.

Sukhinina, A., & Koroleva, E. (2020). Determinants of FinTech performance: Case of Russia. ACM International Conference Proceeding Series. https://doi.org/10.1145/3446434.3446514

Suryanto, S., Rusdin, R., & Dai, R. M. (2020). Fintech As a Catalyst for Growth of Micro, Small and Medium Enterprises in Indonesia. Academy of Strategic Management Journal, 19(5), 1–12.

Teng, S., & Khong, K. W. (2021). Examining actual consumer usage of E-wallet: A case study of big data analytics. Computers in Human Behavior, 121(February), 106778. https://doi.org/10.1016/j.chb.2021.106778

Tikku, S. R., & Singh, A. K. (2023). Financial Disruption and Microentrepreneurs: Empirical Study on Adoption of E-Wallet Among Micro-Entrepreneurs in India. International Journal of E-Collaboration, 19(1), 1–14. https://doi.org/10.4018/IJeC.315780

Trinugroho, I., Pamungkas, P., Wiwoho, J., Damayanti, S. M., & Pramono, T. (2022). Adoption of digital technologies for micro and small business in Indonesia. Finance Research Letters, 45(March), 102156. https://doi.org/10.1016/j.frl.2021.102156

Wahyono, H., Narmaditya, B. S., Wibowo, A., & Kustiandi, J. (2021). Irrationality and Economic Morality of SMEs’ Behavior During the Covid-19 Pandemic: Lesson from Indonesia. Heliyon, 7(April), e07400. https://doi.org/10.1016/j.heliyon.2021.e07400

Yong Ming, K. L., & Soon, L. P. (2023). E-Wallet Revolution: Fueling Business Performance among SMEs in Kuching, Sarawak. International Journal of Academic Research in Business and Social Sciences, 13(6), 919–926. https://doi.org/10.6007/ijarbss/v13-i6/17261

Zainul Arifin, A. (2018). Influence of financial attitude, financial behavior, financial capability on financial satisfaction. Advances in Social Science, Education and Humanities Research (ASSEHR), 186(INSYMA), 100–103. https://doi.org/10.2991/insyma-18.2018.25

Downloads

Published

How to Cite

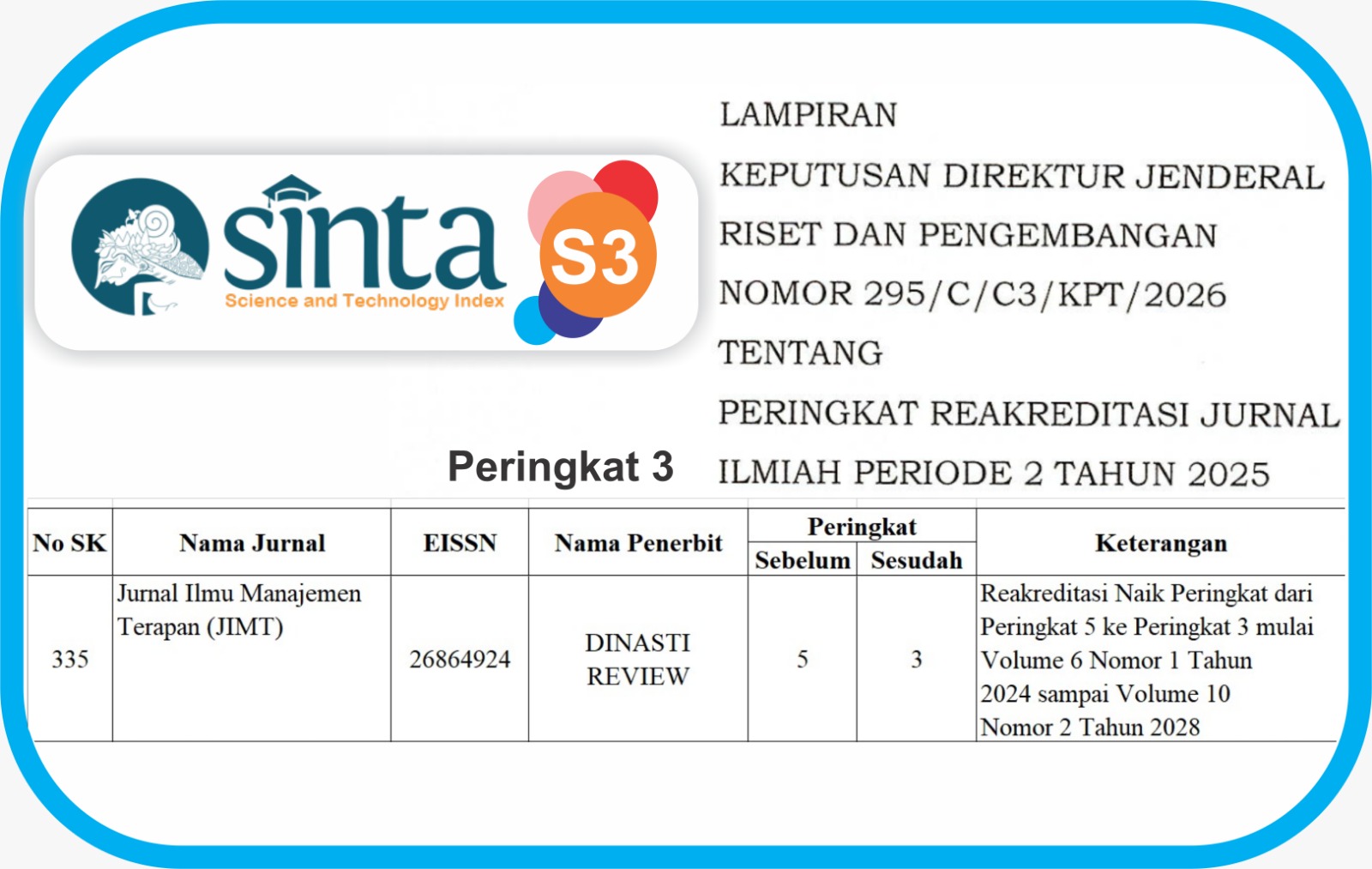

Issue

Section

License

Copyright (c) 2024 Sanci Enjanita, Tona Aurora Lubis, Sigit Indrawijaya

This work is licensed under a Creative Commons Attribution 4.0 International License.

Penulis yang mempublikasikan manuskripnya di jurnal ini menyetujui ketentuan berikut:

- Hak cipta pada setiap artikel adalah milik penulis.

- Penulis mengakui bahwaJurnal Ilmu Manajemen Terapan (JIMT) berhak menjadi yang pertama menerbitkan dengan lisensi Creative Commons Attribution 4.0 International (Attribution 4.0 International CC BY 4.0) .

- Penulis dapat mengirimkan artikel secara terpisah, mengatur distribusi non-eksklusif manuskrip yang telah diterbitkan dalam jurnal ini ke versi lain (misalnya, dikirim ke repositori institusi penulis, publikasi ke dalam buku, dll.), dengan mengakui bahwa manuskrip telah diterbitkan pertama kali di Jurnal Ilmu Manajemen Terapan (JIMT).