PENGARUH TANGIBLE, RESPONSIVENESS, TRUST, COMMUNICATION, DAN SATISFACTION TERHADAP LOYALITAS (INVESTIGASI: BANK “DANA***” DI MALL “TSR”)

DOI:

https://doi.org/10.31933/jimt.v1i5.224Keywords:

Bank, kepercayaan, komunikasi, kepuasan, loyalitasAbstract

Di zaman sekarang ini, bank merupakan bagian yang sulit terpisahkan dalam kehidupan terutama bagi mereka yang tinggal di daerah perkotaan, banyaknya keperluan baik dalam hal bertransaksi atau menabung membuat bank menjadi kebutuhan baik para pengusaha, pedagang maupun pekerja. Tetapi kebutuhan yang tinggi tersebut juga mendapat banyak persaingan yang ketat karena banyaknya bank-bank yang sudah ada membuat sejumlah bank mengalami likuidasi. Loyalitas konsumen yang sekarang sudah ada, sangatlah penting bagi kelangsungan hidup suatu perusahaan, dari penelitian para ahli terdahulu, tercatat sejumlah variabel-variabel independen yang dapat mempengaruhi loyalitas konsumen. Penelitian ini meneliti tentang pengaruh variabel tangible, responsiveness, trust, communication, satisfaction terhadap loyalitas nasabah pada Bank Dana*** di Mall “TSR”, dari 50 sampel responden yang diambil, dengan menggunakan convenient sampling dan dengan model regresi diperoleh hasil bahwa variabel tangible, responsiveness, trust, communication, satisfaction memiiki pengaruh positif terhadap loyalitas, namun hanya variabel responsiveness, communication dan satisfaction yang pengaruhnya signifikan.

References

Alawni, M.S., Yusoff, R.Z., Al-Swidi, A.K., Al-Matari, E.M.. “The Relationship between Communication, Customer Knowledge and Customer Loyalty in Saudi Arabia Insurance Industry Companies”. Mediterranean Journal of Social Sciences. 6 (1), 318-324.

Aritonang R, Lerbin R. (2007). Riset Pemasaran. Cetakan Pertama. Jakarta: Ghalia Indonesia.

Ball, D., Coelho, P.S., Machas, A. (2004). “The role communication and trust in explaining customer loyalty”. European Journal of Marketing. 38 (9/10), 1272-1293.

Bontis, Nick, Booker, Lorne, D., & Serenko, A. (2007). “The mediating effect of organizational reputation on customer loyalty and service recommendation in the banking industry”. Manage. Decision., 45 (9), 1425-1445.

Chiguvi, Douglas & Guruwo, Paul T. (2015). “Impact of Customer Satisfaction on Customer Loyalty in the Banking Sector”. International Journal of Scientific Engineering and Research (IJSER). 5 (2), 55-63.

______________ (2016). “Effectiveness of Cellphone Banking on Service Quality in Commercial Banks in Botswana”, International Journal of Science and Research (IJSR), Vol.5 (8), 1334 -1345.

Duffy, D. L. (2003). “Internal and external factors which affect customer loyalty”. Journal of Consumer Marketing, 20 (5), 480-485.

Griffin, Jill. (2005). Customer Loyalty: Menumbuhkan dan Mempertahankan Kesetiaan Pelanggan. Alih bahasa: Dwi Kartini Yahya dan kawan kawan. Jakarta: Erlangga.

Iddrisu, A.M., Nooni, I.K., Fianko, K.S., Mensah, W. (2015). “Assesing The Impact Of Service Quality On Customer Loyalty: A Case Study Of The Cellular Industry Of Ghana”. British Journal of Marketing Studies. 3 (6), 15-30

Khan, M.M. & Fasih, Mariam. (2014). “Impact of Service Quality on Customer Satisfaction and Customer Loyalty: Evidence from Banking Sector”. Pakistan Journal of Commerce and Social Sciences, 8 (2), 331- 354.

Leninkumar, Vithya. (2016). “The effect of service quality on customer loyalty”. European Journal of Business and Management. 8 (33), 44-49.

Mohsan, F., Nawaz, M.M., Khan, M. S., Shaukat, Z. & Aslam, N. (2011). “Impact of Customer Satisfaction on Customer Loyalty and Intentions to Switch: Evidence from Banking Sector of Pakistan”. International Journal of Business and Social Science, 2 (16); September.

Mowen, J. C. & Minor, Michael. (2002). Perilaku Konsumen. Jilid Satu. Erlangga : Jakarta.

Ndubisi, Nelson Oly. (2007). “Relationship Marketing and Customer Loyalty”. Marketing Intelligence & Planning. 25, (1), 98-106.

Ou, W.M., Shih, C.M., Chen, C.Y. & Wang, K.C. (2011). “Relationships among customer loyalty programs, service quality, relationship quality and loyalty: An empirical study, Chinese management Studies”, 5 (2), 194- 206

Rizan, Prasetya, & Kresnamurti. (2014). “Pengaruh Kualitas Produk dan Kualitas Pelayanan Terhadap Kepuasan Pelanggan (Survei Terhadap Pengguna Laptop Merek Toshiba dan Pengguna Laptop Merek Acer)”. Jurnal Riset Manajemen Sains Indonesia (JRMSI), 5, No. 1.

Saeed, R., Rehman, A. U., Akhtar, N., & Abbas, M. (2014). “Impact of Customer Satisfaction and Trust on Customer Loyalty Mediating Role of Commitment (Evidence from Petroleum Sector of Pakistan)”. Journal of Basic and Applied Scientific Research. 4 (2), 214-221

Sarwar, , M. Z., Abbasi, K. S., & Pervaiz, Saleem. (2012). “The Effect of Customer Trust on Customer Loyalty and Customer Retention: A Moderating Role of Cause Related Marketing”. Global Journal of Management and Business Research, 12 (6), 28-36

Sudjana. (1997). Analisis Strategi Bauran Pemasaran, Jakarta: Unika Atmajaya.

Sugiyono. (2003). Metode Penelitian Bisnis. Bandung: Alfabeta.

Zeithaml, V.A. Bitner, Mary J. Gremler, Dwayne D. (2003), Service Marketing Integrating Customer Focus Across the Firm, International Edition, 3th Editon. New York: Mc Graw Hill Companies. Inc.

https://www.cnbcindonesia.com

Downloads

Published

How to Cite

Issue

Section

License

Penulis yang mempublikasikan manuskripnya di jurnal ini menyetujui ketentuan berikut:

- Hak cipta pada setiap artikel adalah milik penulis.

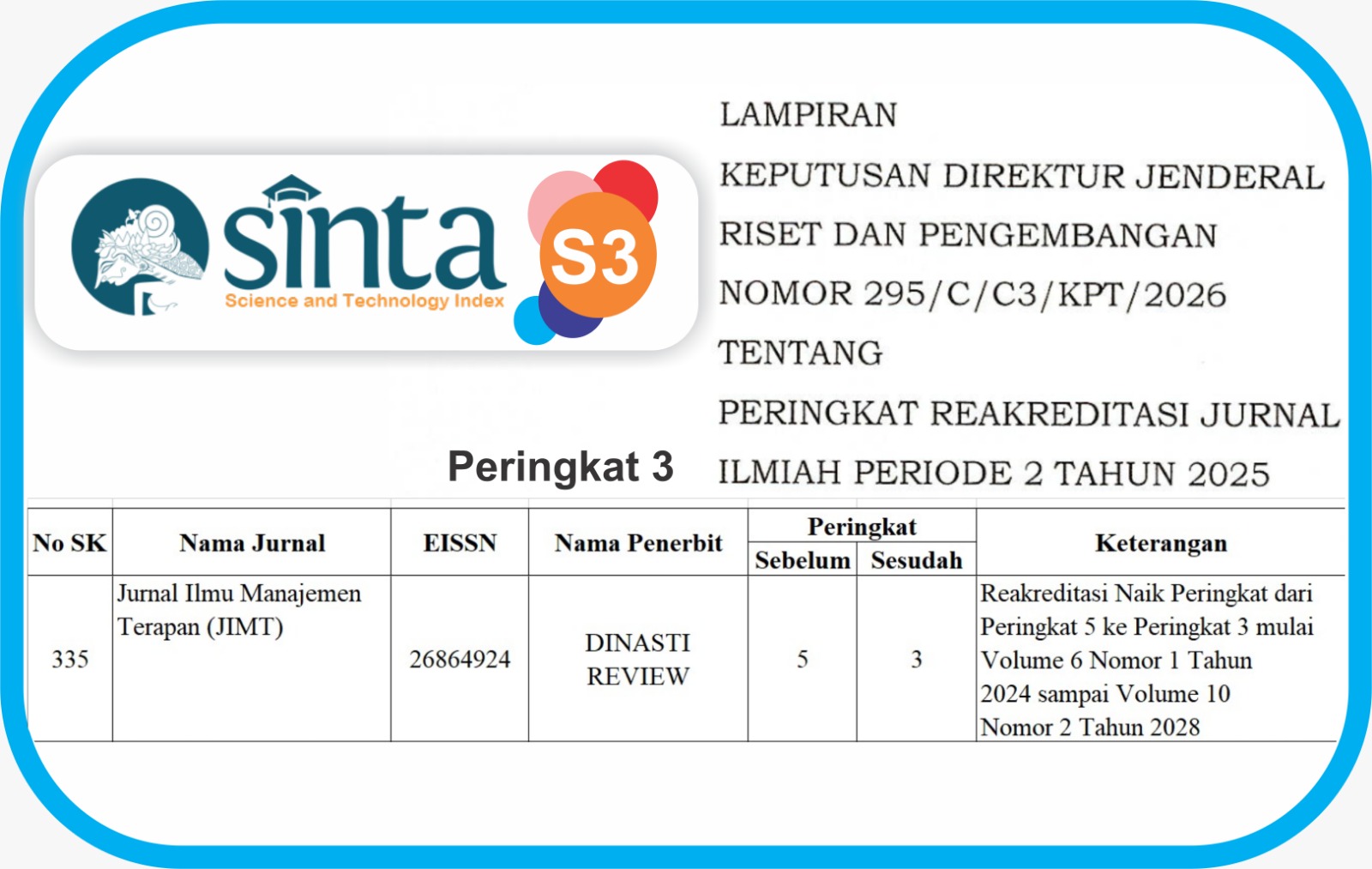

- Penulis mengakui bahwaJurnal Ilmu Manajemen Terapan (JIMT) berhak menjadi yang pertama menerbitkan dengan lisensi Creative Commons Attribution 4.0 International (Attribution 4.0 International CC BY 4.0) .

- Penulis dapat mengirimkan artikel secara terpisah, mengatur distribusi non-eksklusif manuskrip yang telah diterbitkan dalam jurnal ini ke versi lain (misalnya, dikirim ke repositori institusi penulis, publikasi ke dalam buku, dll.), dengan mengakui bahwa manuskrip telah diterbitkan pertama kali di Jurnal Ilmu Manajemen Terapan (JIMT).