Pengaruh Literasi Keuangan, Gaya Hidup, dan Locus of Control Terhadap Perilaku Keuangan Generasi Z pada Cashless Society

DOI:

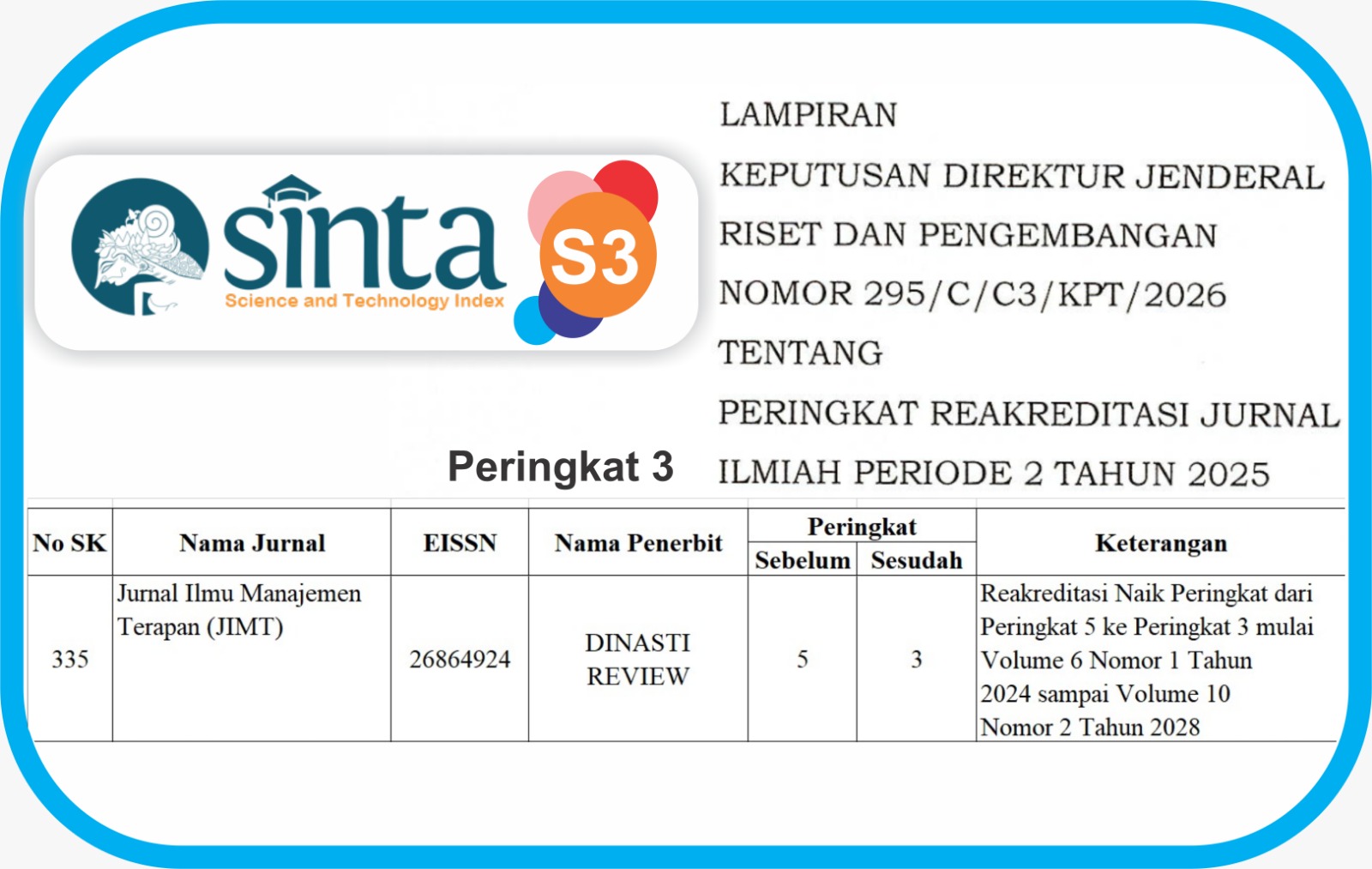

https://doi.org/10.31933/jimt.v4i6.1637Keywords:

Financial Behavior, Financial Literacy, Lifestyle, Locus of ControlAbstract

This study aims to measure the effect of financial literacy, lifestyle and locus of control as independent variables, on financial behavior in the cashless society as the dependent variable. The sample used is generation Z in DKI Jakarta who uses non-cash transactions. The sampling method uses a purposive sampling method where the researcher has determined the sampling by determining the specific characteristics that are in accordance with the research objectives. This research analysis uses multiple linear regression analysis with a significance level of 5 percent, which is processed using the Statistical Package for Social Science (SPSS) version 25 program. The results of this study indicate that 1) Financial Literacy has a positive effect on Financial Behavior. 2) Lifestyle has a positive effect on Financial Behavior. 3) Locus of Control has no effect on Financial Behavior, 4) Financial Literacy, Lifestyle, and Locus of Control have a positive effect on Financial Behavior.

References

BI. (2023). Proyek Garuda: Menavigasi Arsitektur Digital Rupiah. Bank Indonesia. https://www.bi.go.id/id/rupiah/digital-rupiah/default.aspx#heading8

Dewanti, V. P., & Asandimitra, N. (2021). Pengaruh Financial Socialization, Financial Knowledge, Financial Experience terhadap Financial Management Behavior dengan Locus of Control sebagai Variabel Mediasi pada Pengguna Paylater. Jurnal Ilmu Manajemen, 9(3), 863–875. https://doi.org/10.26740/jim.v9n3.p863-875

Elitasari, A., Wiyono, G., & Maulida, A. (2022). The Effect Of Financial Literature, Lifestyle, Income, And Gender On The Financial Behavior Of The Millenial Generation. Invoice: Jurnal Ilmu Akuntansi, 4(2), 232–247.

Fathihani, Herawaty, Y., & Apriani, A. (2021). PENERAPAN PERILAKU HIDUP BERSIH DAN SEHAT (PHBS) DAN PENGGUNAAN HERBAL IMUNITI DI MASA NEW NORMAL DI LINGKUNGAN KELURAHAN TANJUNG DUREN. Fakultas Bisnis Dan Ilmu Sosial, Prodi Manajemen, Universitas Dian Nusantara, Jakarta, Volume 1(Issue 1). http://jurnal.undira.ac.id/index.php/andhara

Herlina Budiono, Hendra Wiyanto, Y. I. P. (2019). Keterkaitan Pengetahuan dan Perencanaan Keuangan Terhadap Perilaku Karyawan Pria. Jurnal Ekonomi, 24(2), 176. https://doi.org/10.24912/je.v24i2.567

Nirmala, Miftah, M., & Murtatik, S. (2020). Analisis Gaya Hidup dan Literasi Keuangan Terhadap Perilaku Mahasiswa dalam Cashless Society. Fakultas Ekonomi Dan Bisnis Universias Pembangunan Nasional “Veteran” Jakarta, 37(2), 172–178. https://ci.nii.ac.jp/naid/110003378770/

Pradiningtyas, T. E., & Lukiastuti, F. (2019). Pengaruh Pengetahuan Keuangan dan Sikap Keuangan terhadap Locus of Control dan Perilaku Pengelolaan Keuangan Mahasiswa Ekonomi. Jurnal Minds: Manajemen Ide Dan Inspirasi, 6(1), 96. https://doi.org/10.24252/minds.v6i1.9274

Prihartono, M. R. D., & Asandimitra, N. (2018). Analysis Factors Influencing Financial Management Behaviour. International Journal of Academic Research in Business and Social Sciences, 8(8), 308–326. https://doi.org/10.6007/ijarbss/v8-i8/4471

Putra, P. D., Harahap, K., & Rahmah, S. S. (2020). the Hedonism Lifestyle, Financial Literacy and Financial Management Among Business Education Students To Financial Management. Journal of Community Research and Service, 4(1), 32. https://doi.org/10.24114/jcrs.v4i1.18287

Ramadanti, H., Nawir, J., & Marlina. (2021). Analisis Perilaku Keuangan Generasi Z Pada Cashless Society. Jurnal Visionida, 7(2), 96–109.

Sampoerno, A. E., & Haryono, N. A. (2021). Pengaruh Financial Literacy, Income, Hedonism Lifestyle, Self-Control, dan Risk Tolerance terhadap Financial Management Behavior pada Generasi Milenial Kota Surabaya. Jurnal Ilmu Manajemen, 9(3), 1002–1014. https://doi.org/10.26740/jim.v9n3.p1002-1014

Sudarmanto, E., Kurniullah, A. Z., Revida, E., Ferinia, R., Butarbutar, M., Abdilah, L. A., Sudarso, A., Purba, B., Purba, S., Yuniwati, I., Hidayatulloh, A. N., HM, I., & Suyuthi, N. F. (2021). Desain penelitian Bisnis: Pendekatan Kuantitatif (p. 244 halaman). Yayasan Kita Menulis.

Wahyudi, W., Tukan, B. A. P., & Pinem, D. (2020). Analysis of the Effect of Financial Literation, Financial Technology, Income, and Locus of Control on Lecturer Financial Behavior. AFEBI Management and Business Review, 5(1), 37. https://doi.org/10.47312/ambr.v5i1.293

Widiawati, M. (2020). Pengaruh Literasi Keuangan, Locus of Control , Financial Self-Efficacy, dan Love of Money Terhadap Manajemen Keuangan Pribadi. Prisma (Platform Riset Mahasiswa Akuntansi), 1(1), 97–108.

Wiranti, A. (2022). Pengaruh Financial Technology, Financial Literacy, Financial Knowledge, Locus Of Control dan Income Terhadap Perilaku Keuangan. Jurnal Ilmu Manajemen, 10(2), 475–488.

Downloads

Published

How to Cite

Issue

Section

License

Penulis yang mempublikasikan manuskripnya di jurnal ini menyetujui ketentuan berikut:

- Hak cipta pada setiap artikel adalah milik penulis.

- Penulis mengakui bahwaJurnal Ilmu Manajemen Terapan (JIMT) berhak menjadi yang pertama menerbitkan dengan lisensi Creative Commons Attribution 4.0 International (Attribution 4.0 International CC BY 4.0) .

- Penulis dapat mengirimkan artikel secara terpisah, mengatur distribusi non-eksklusif manuskrip yang telah diterbitkan dalam jurnal ini ke versi lain (misalnya, dikirim ke repositori institusi penulis, publikasi ke dalam buku, dll.), dengan mengakui bahwa manuskrip telah diterbitkan pertama kali di Jurnal Ilmu Manajemen Terapan (JIMT).